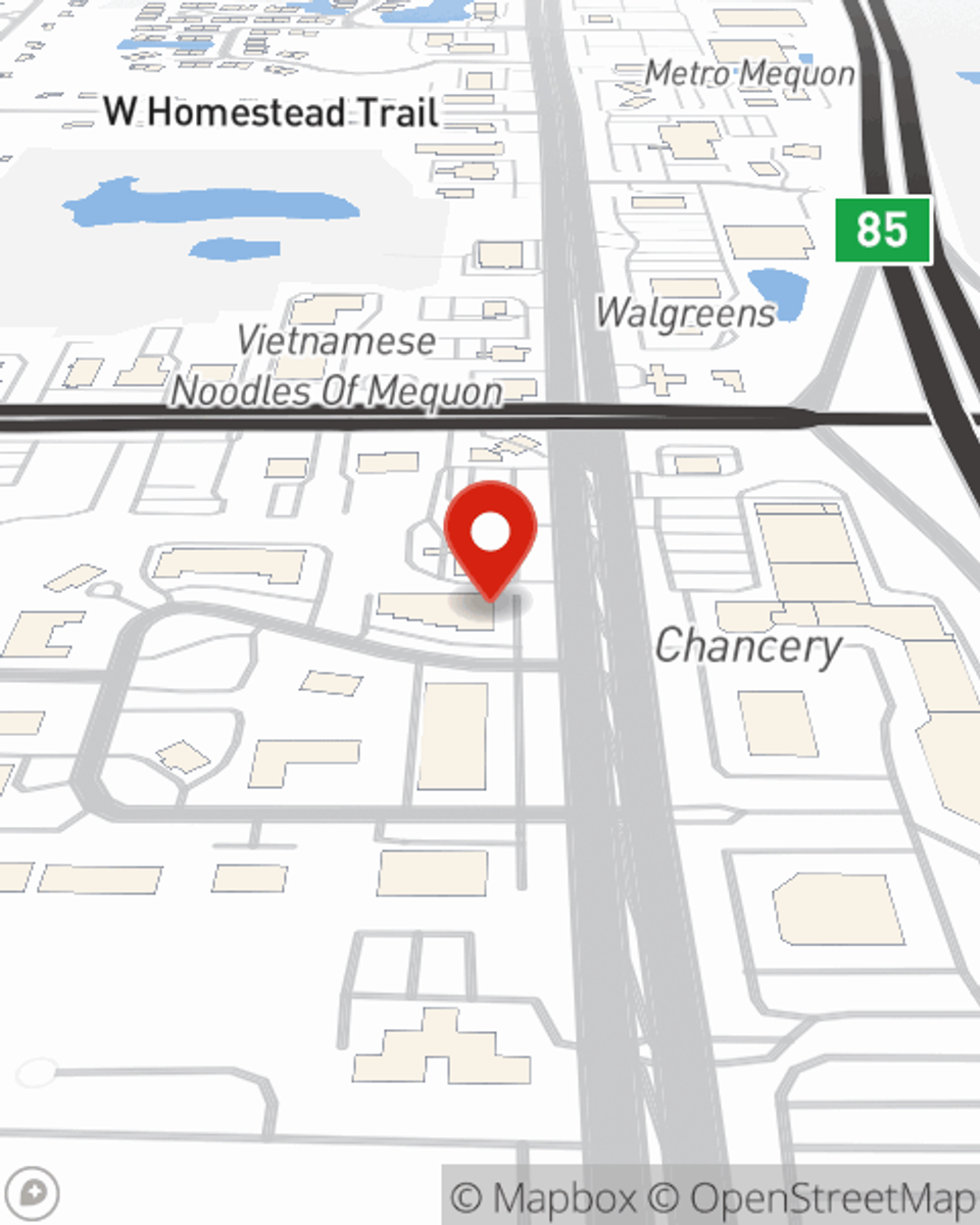

Renters Insurance in and around Mequon

Mequon renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Mequon

- Thiensville

- Cedarburg

- Milwaukee

- Ozaukee

- West Bend

- North Shore

- MKE

- Janesville

- Brown Deer

- Jackson

- Grafton

- Port Washington

- Waukesha

- Washington

- Sheboygan

Protecting What You Own In Your Rental Home

It may feel like a lot to think through managing your side business, work, family events, as well as coverage options and savings options for renters insurance. State Farm offers no-nonsense assistance and unbelievable coverage for your linens, electronics and sports equipment in your rented home. When trouble knocks on your door, State Farm can help.

Mequon renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Open The Door To Renters Insurance With State Farm

You may be wondering if you really need Renters insurance, but what many renters don't know is that your landlord's insurance generally only covers the structure of the property. What would happen if you had to replace your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when thefts or accidents occur.

If you're looking for a value-driven provider that can help you protect your belongings and save, get in touch with State Farm agent Andrew Stark today.

Have More Questions About Renters Insurance?

Call Andrew at (262) 241-5920 or visit our FAQ page.

Simple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.

Andrew Stark

State Farm® Insurance AgentSimple Insights®

Answers about automatic fire sprinkler systems

Answers about automatic fire sprinkler systems

Commercial sprinkler systems are a key step in fire protection. If you have questions, get answers to help protect your business from devastating fire damage.

Compare different types of mortgages

Compare different types of mortgages

Knowing the different types of mortgages can be confusing. Learn the different mortgage types and determine what may work best for you.