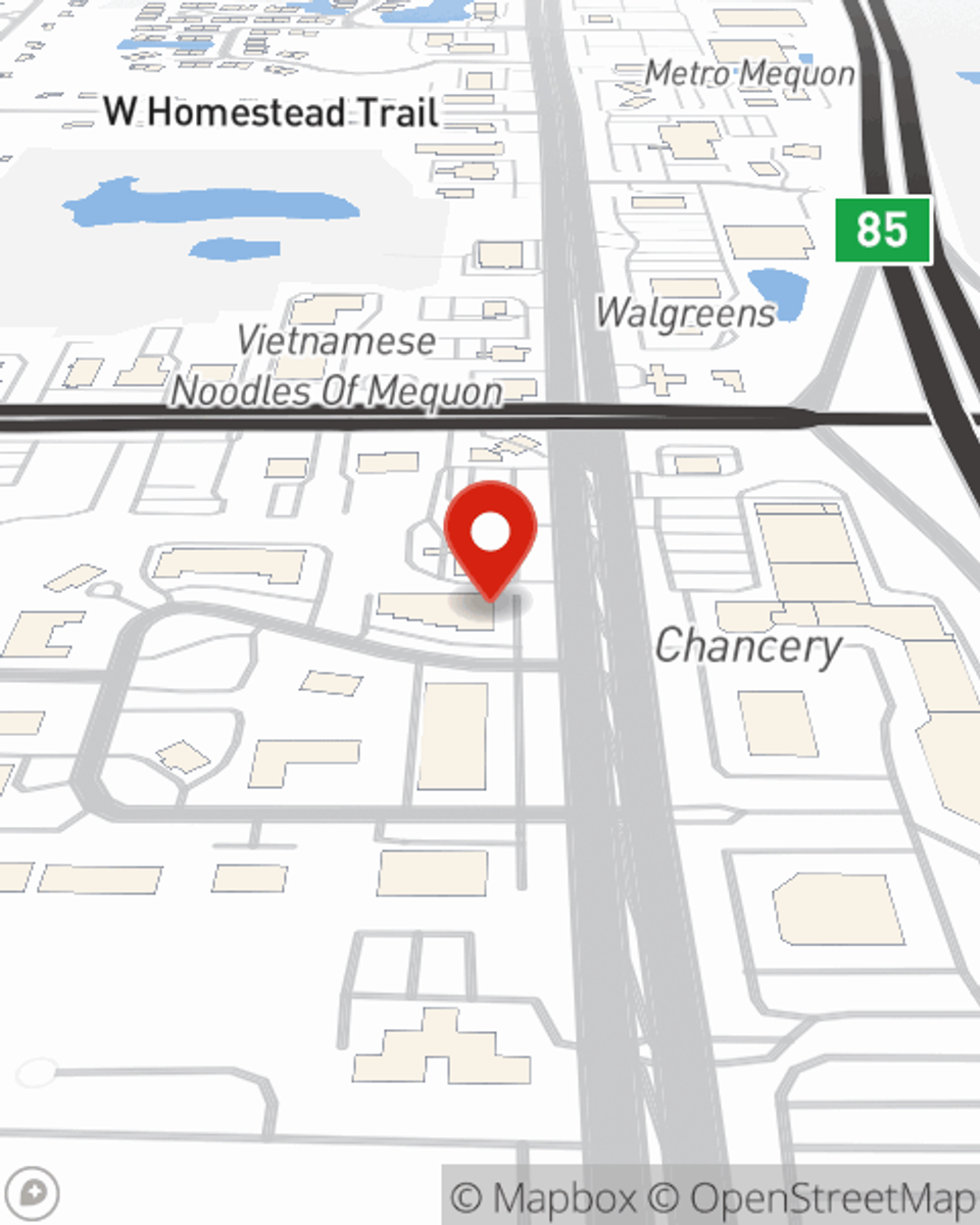

Condo Insurance in and around Mequon

Townhome owners of Mequon, State Farm has you covered.

Condo insurance that helps you check all the boxes

- Mequon

- Thiensville

- Cedarburg

- Milwaukee

- Ozaukee

- West Bend

- North Shore

- MKE

- Janesville

- Brown Deer

- Jackson

- Grafton

- Port Washington

- Waukesha

- Washington

- Sheboygan

Condo Sweet Condo Starts With State Farm

Often, your haven is where you are most able to relax and enjoy the ones you love. That's one reason why your condo means so much to you.

Townhome owners of Mequon, State Farm has you covered.

Condo insurance that helps you check all the boxes

Condo Coverage Options To Fit Your Needs

Your condo is a special place. You need condo unitowners coverage to keep it safe! You’ll get that with Condominium Unitowners Insurance from State Farm, a trusted provider of condo unitowners insurance. Andrew Stark is your understanding State Farm Agent who can present coverage options to see which one fits your individual needs. Andrew Stark can walk you through the whole coverage process, step by step. You can have a hassle-free experience to get coverage options for everything that's meaningful to you. We’re talking about more than just protection for your home gadgets, linens and electronics. You'll want to protect your family keepsakes—like mementos and collectibles. And don't forget about all you've collected for your hobbies and interests—like tools and sound equipment. Agent Andrew Stark can also let you know about State Farm’s great savings and coverage options. There are savings if you carry multiple lines of State Farm insurance or have a claim-free history, and there are plenty of different coverage options, such as personal articles policy and even additional business property.

When your Mequon, WI, condo is insured by State Farm, even if the worst comes to pass, State Farm can help guard your condo! Call or go online now and see how State Farm agent Andrew Stark can help you protect your condo.

Have More Questions About Condo Unitowners Insurance?

Call Andrew at (262) 241-5920 or visit our FAQ page.

Simple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.

Andrew Stark

State Farm® Insurance AgentSimple Insights®

Do you need a real estate agent to buy a house?

Do you need a real estate agent to buy a house?

While it's possible to buy or sell a house without a realtor, there are advantages that you shouldn't discount because you think it will save money.

Help protect your home and family with home security

Help protect your home and family with home security

Security and burglar alarms systems help deter burglars and protect your home. Learn more about monitored systems and security alarms.

Home safety checklist

Home safety checklist

Consider these home safety measures to help prevent common household injuries.

What is HO-6 insurance?

What is HO-6 insurance?

Condo insurance coverage works along with the condo association’s master policy. Learn more about how they work together to protect you and your stuff.